What is the Minimum EROI that a Sustainable Society Must Have? Part 2: The Economic Cost of Energy, EROI, and Surplus Energy

Posted by David Murphy on March 24, 2010 - 10:03am in The Oil Drum: Net Energy

The following multi-part series is taken from a paper that my colleagues and I published last year in the free, on-line journal Energies. You may access the entire PDF here. All references can be found in the pdf. Part 1 can be found here.

The first section of this post discusses how the economic cost of energy changes with changes in the price of energy. The second section discusses the impact of declining EROI on economies; specifically this section addresses whether or not the time trend of EROI supports the claim by some economists that advances in technology will overcome the depletion of fossil fuels. The third section discusses how surplus energy is used to run the economy by analyzing a simplified economy that is powered by oil only.

2.2. Economic Cost of Energy

In real economies, energy comes from many sources – from imported and domestic sources of oil, coal and natural gas, as well as hydropower and nuclear, and from a little renewable energy – most of that as firewood but increasingly from wind etc. Most of these are cheaper per unit energy delivered than oil. So let’s look at what this real ratio of the cost of energy (from all sources, weighed by their importance) is relative to its benefits.

Economic cost of energy = Dollars to buy energy / GDP

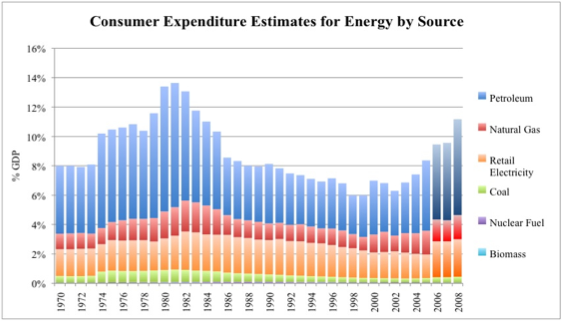

By this token the relation of the proportional energy cost in dollars is similar, as we shall see, to the proportional energy cost in joules; in 2007 roughly 9 percent (1 trillion dollars) of the U.S. GDP was spent by final demand for all kinds of energy in the US economy to produce the 12 trillion dollars worth of total GDP (Figure 1). This ratio certainly increased in the first half of 2008 as the price of oil exceeded $140 a barrel and then fell again. The abrupt rise in the 1970s, subsequent decline through 2000, and increase again through mid 2008 of this value had large impacts on discretionary spending because the 5 to 10 percent change in total energy cost would come mainly out of the 25 or so percent of the economy that is discretionary spending. Thus we believe that changes in energy prices have very large economic impacts. At least thus far the changes in price seem to reflect the generally decreasing EROI only sporadically although that seemed to be changing recently until the economic crash of fall 2008, when collapsing demand took over. What future prices will be is anyone’s guess but even as economies crash there is a great deal of information implying that dollar, and hence presumably energy, costs of fuels are increasing substantially. Our guess is that declining EROI will take a huge economic toll in the future [6].

Figure 1. Percentage of GDP that is spent on energy by final consumers (2006-2008 estimated).

2.3. EROI for U.S. and North American Domestic Resources and Its Implications for the “Minimum EROI”

In the past the first author worked with Cutler Cleveland and Robert Kaufmann to define and calculate the energy return on investment (EROI) of the most important fuels for the United States’ economy. Since that time Cleveland has undertaken additional and updated analyses for the US economy and Nate Gagnon and Hall have attempted to do that for the world average. Our results indicate that there is still a very large energy surplus from fossil fuels -- variously estimated as an EROI (i.e. EROImm) from perhaps 80 to one (domestic coal) to perhaps 11-18 to one (US) to 20 to one (World) for contemporary oil and gas. In other words, globally for every barrel of oil, or its equivalent, invested in seeking and producing more oil some 20 barrels are delivered to society. Thus fossil fuels still provide a very large energy surplus, obviously enough to run and expand the human population and the very large and complex industrial societies around the world. This surplus energy of roughly 20 or more units of energy returned per unit invested in getting it, plus the large agricultural yields generated by fossil-fueled agriculture, allows a huge surplus quantity of energy, including food energy, delivered to society. This in turn allows most people and capital to be employed somewhere else other than in the energy industry. In other words these huge energy surpluses have allowed the development of all aspects of our civilization -- both good and bad.

That’s the good news. The bad news is that the depletion of fossil fuels has been occurring since the first ton of coal or barrel of oil was mined, since these fuels need about 100 or so million years to regenerate. Many economists argue that technology, the market and economic incentives will continue to find oil to replace that which we have extracted, or that prices will increase as oil reserves deplete and society will substitute away from oil as technologies are developed that allow for such a substitution [21]. Thus one can argue that depletion and technology are in a race over time. Which is winning?

We argue that one can determine this from the time trend of EROI. The EROI for oil in the US during the heydays of oil development in Texas, Oklahoma and Louisiana in the 1930s was about 100 returned for one invested [22]. During the 1970s it was about 30:1, and for about 2000 it was from 11 to 18 returned per one invested [3, 4, 22]. For the world the estimate was about 35:1 in the late 1990s declining to about 20:1 in the first half decade of the 2000s (Gagnon et al. in preparation). In addition there is considerable evidence that, in the case of oil, we are mostly just pumping out old fields rather than replacing extracted oil with newly found oil. Globally we are using between 2 to 3 barrels for each new barrel found [23]. The analysis of Gagnon et al. suggests that if current trends continue linearly then in about two to three decades it will take one barrel of petroleum to find and produce one barrel of petroleum, and oil and eventually gas will cease to be a net source of energy. (A special case can be made for e.g. tar sands, where it may make sense to extract two barrels from the ground, use one for the process and then deliver the second barrel to society). This also means that the question is not necessarily what the size of global oil reserves is but rather what is the size of that portion that is extractable with a positive net energy value and at what rate the high EROI fuels can be produced. The implications of this are obvious and huge, and help make an argument for seeking possible substitutes earlier rather than later [6].

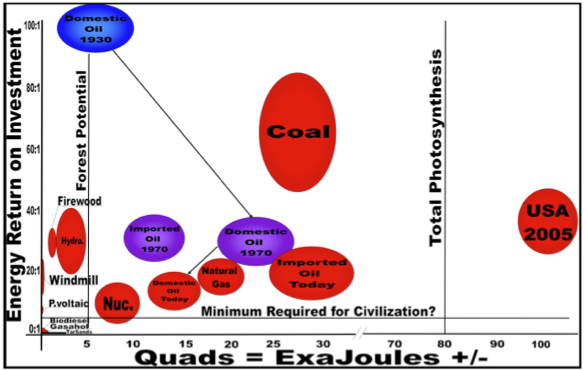

But the problem with substitutes to fossil fuels is that of the alternatives available none appear to have the desirable traits of fossil fuels. These include: 1) sufficient energy density 2) transportability 3) relatively low environmental impact per net unit delivered to society 4) relatively high EROI and 5) are obtainable on a scale that society presently demands (Figure 2). Thus it would seem that society, both the US and the world, is likely to be facing a decline in both the quantity and EROI of its principal fuels. Our next question is “what are the implications of this?”

Figure 2. “Balloon graph” representing quality (EROI – Y axis) and quantity (X axis) of the United States economy for various fuels at various times. Arrows connect fuels from various times (i.e. domestic oil in 1930, 1970, 2005 – “today”), and the size of the “balloon” represents part of the uncertainty associated with EROI estimates, i.e. larger “balloons” represent more uncertainty. The horizontal line indicates that there is some minimum EROI that is needed to make society work, and the vertical line to the left indicates one estimate of maximum forestry potential and the vertical line to the right is David Pimentel’s earlier estimate of total photosynthesis in the United States (Source: US EIA, Cutler Cleveland and C. Hall’s own EROI work in preparation). (Reprinted with minor changes from [6]).

3. The surplus available to run the rest of the economy

We first generate a simplistic view of the economy in every day units to try to develop for the reader an explanation of how an economy obtains the energy needed for its own function and how differences in EROI might affect that. Assume for the moment that the United States’ economy runs 100 percent on domestic oil, and that energy itself is not what is desired by the final consumer but rather the goods and services derived from the general economy. In the early years of this new millennium the U.S. Gross Domestic Product (proxy variable for the size of the U.S. economy) was about 12 trillion dollars, and it used about 100 quadrillion BTUs (called Quads, equal to 1015 BTUs), which is equivalent to about 105 ExaJoules (1 EJ equals 1018 Joules). Dividing the two we find that we use an average of about 8.7 Mega Joules (1 MJ equals 106 joules) to generate one dollar’s worth of goods and services in 2005. By comparison, gasoline at $3 per gallon delivers about 44 MJ per dollar (at 130.8 MJ per gallon of gasoline), plus roughly another ten percent to get that gasoline (refinery cost ≈ 4 MJ), so if you spend one dollar on energy directly vs. one dollar on general economic activity you would consume about 48/8.3 or 5.8 times more energy.

In the 1970s analyses were undertaken by Bullard, Hannon, Herendeen [24] and Costanza [25] that showed that (except for energy itself) it does not matter enormously where money is spent within final demand due to the complex interdependency of our economy (that is, the final products that consumers buy are relatively unimportant to overall GDP/energy efficiency because there are so many interdependencies, i.e. each sector purchases from many others within our economy, although this does not apply to the intermediate products purchased by manufacturers). According to Costanza [25], the market selects for generating a similar amount of wealth per unit of energy used within the whole economic “food chain” leading to final demand. While this is not exactly true it is close enough for our present purposes and it is certainly true for the average of all economic activity.

What is the energy “price” of the oil in this example to 1) the country (either domestic or if it is imported) and 2) to the consumer -- relative to the total economic activity of each entity? One can do some simple math. There are about 6.1 GJ in a standard 42 gallon barrel of oil, so the 105 EJ of industrial energy the U.S. uses to run its economy for a year is equivalent to roughly 17 billion barrels of oil. At $70 per barrel that amount of oil would take 1.2 trillion dollars to purchase (or at 3 dollars a gallon, 2.1 trillion to the consumer), which is either about one tenth of GDP, or one sixth if we consider it from the perspective of the consumer (the difference between the two estimates going to the oil companies after production or to refineries, gas station attendants etc. as inputs, profits, wages, delivery costs etc.). Thus the price of energy delivered to the consumer is roughly twice that of the wellhead price (or much more if converted to electricity).

Now assume that the real price of oil, that is the price of oil relative to other goods and services, increased by two, that is to $140 a barrel in today’s dollars (which it did briefly in 2008), and that the total size of the economy stayed the same – that is some other components of the economy were diverted to pay for that oil. If that happened, then one fifth (17 billion times 140 = $2.38 trillion/12 trillion) of the economy would be used to buy the oil to run the other four fifths (that is that part not including the energy extraction system itself). If the price of oil increased to $250 per barrel, about one third of all economic activity would be required to run the other two thirds, and at $750 a barrel then the output of the entire economy, that is 12 trillion dollars, would be required to generate the money to purchase the energy required to run the economy, i.e. there would be no net output. While in fact in a real economy there would be many adjustments, alternative fuels and nuances this analysis does at least give an overview of the relation of gross to net economic activity, and the importance of EROI in energy and economic terms to the rest of the economy. As the price of fuel increases (or as its EROI declines) there are large impacts on the rest of the economy. These impacts can be especially influential because changes in the price of energy tend to impact discretionary, not base, spending.

Of course most of our energy costs less than oil so that the 70 dollars a barrel we used in the example above translates to – in the real economy -- the equivalent of about $35 a barrel equivalent at the source or $70 a barrel by the time the consumer gets the energy, hence we can assume for this scenario that on average about 10 percent of the dollar economy (i.e. $70 times 17 billion barrels or 1.2 trillion out of 12 trillion dollars) is used just to purchase the energy that allows the rest of the economy to function, which produces the end products we want. This 10 percent of our economic activity means that roughly ten percent of all workers’ time, ten percent of the energy used in their jobs, and ten percent of the total materials consumed were used in some sense to simply get the energy to the final consumer to make the rest of the economy work. According to the official statistics of the U.S. Energy Information Agency in 2007 the cost of energy to the consumer was about 9 percent of the total U.S. economy Figure 1), so our numbers seem about right on average.

I was mildly surprised to see nuclear so low.

The biodiesel does not seem to incorporate algal diesel. If so, please provide the references.

I also note that solar thermal (hot water, passive heat, active heat) is not provided, though has a good EROI and EROEI.

Estimates for the EROEI for nuclear have been trending down for years as the factors that were included have been refined. For example, some early estimates were based on thermal energy; but upwards of 70% of the thermal energy produced by the reactor is wasted to the atmosphere or nearby bodies of water in a typical situation. Other items included more accurate information about the energy required to mine, enrich, and fabricate the fuel; the energy cost of reprocessing; plant decommissioning.

I have been slowly coming to the conclusion that expanding the current thermal-neutron once-through fuel cycle used in the US is, if not a waste of effort, not a long-term strategy. OTOH, some combination of modular designs and fast-neutron fuel cycles would seem to address a number of the issues and have better EROEI characteristics.

You should be surprised; the graph is BS like the Storm Smith Van Leuwen papers. Even with the LWR once-through fuel cycle, using centrifuge enrichment the EROEI is over 100:1. Worldwide, 2/3 of uranium enrichment is now done using centrifuges.

Using Integral Fast Reactors, it may be as much as 1000:1. These reactors would eliminate the need for mining, milling, and enrichment of uranium.

http://bravenewclimate.com/2010/03/08/tcase8/

It is also absurd to put coal so high; coal in recent decades has fallen to the same EROEI as nuclear LWRs using diffusion enrichment: around 15 or 20:1. Why did we go with coal? Why do you think-- religion and ideology.

http://www.sustainablenuclear.org/PADs/pad0509till.html

EROEI comments aside, this article is about EROI (I = money, not BTUs).

Wrong. "I" here refers to energy not money. See here (page 2 of the pdf) for David Murhpy's terminology defined.

This is one reason I never use the term "EROI" myself.

So, lemme see if I get this.... if the EROI from all sources averages out to less than 10:1, things start to break. The higher the EROI, the lower the percentage of GDP spent on energy required to keep everything afloat.

Yup, it appears to be breaking.

Where would human-power fall on the "balloon" graph? That is, human labor fueled by food acquired through slash/midden farming, hunting and gathering?

You are starting at the "top" and working your way down. Why not start at the "bottom" and work your way "up"?

from: http://www.smithsonianmag.com/history-archaeology/gobekli-tepe.html#ixzz...

Read more: http://www.dailymail.co.uk/sciencetech/article-1157784/Do-mysterious-sto...

Abel presented God a sacrifice of animals from the herd. Cain presented God a sacrifice from the things grown in the field. God looked with favor on Abel’s sacrifice and disfavor on Cain’s sacrifice. God prefers meat eaters. Just joking. People became farmers because they could store more calories over time allowing civilization to grow.

hotrod

-Seen in this way, the Eden story, in Genesis, tells us of humanity's innocent and leisured hunter-gatherer past, when we could pluck fruit from the trees, scoop fish from the rivers and spend the rest of our days in pleasure.-

The Daily Mail has rose tinted glasses 3 feet thick.

EROEI is only valid in cases where the form of energy in and the form of energy out are the same or nearly the same. It is valid for oil where oil is the main input and also the main output. It was also valid back in the day of coal powered coal mines.

EROEI is not valid when comparing different forms of energy since there might be a gain in utility or other attributes that offset low EROEI numbers. This is true with fossil fuel electricity and also ethanol.

Things that are different can not be compared. If they are anyway the result is silly nonsense.

Except in the case of like input and output EROEI is junk science.

x,

I'm intrigued by your objection but I don't fully understand it.

To take an example, isn't the extra utility derived from installed infrastructure (say, roads or fiber-optic cables) something that can only be properly considered by accounting for the energy inputs required to construct those things over their usable lifetimes? So, are you asserting that the utility of such things is so great that their energy cost is negligible?

Thanks

Matt,

as you appear to be a relatively new member to TOD, you would need to read across years of posts to get a clearer picture of some of ideologies of the persons that frequent here. X's response (to me) would appear to be a post that comes accross as based on personal ideologies.

IIRC based on what I have been following, X has LONG been a staunch supporter (to put it mildly) of corn based (CB)ethanol as a realistic alternative to FF. While yes, there is a niche for CB ethanol, it cannot escape thermodynamic laws. Is it net positive? arguably yes - although barely. Will it be a silver bullet? no.

I'm not trying to dredge out this CB ethanol argument for further re-hashing - this has been done over and over and over again on this site.

So as a long time reader, part time poster, this comes across as yet another attempt to push arguments against EROEI - to eliminate/discredit one of the arguments against CB ethanol.

I think you guys have been way too snotty/snobbish regarding x. A very closed minded attitude in my opinion. I am not supporting his ethanol bias in the slightest but in general he is either ignored or treated rudely. How open minded is that? The guy is not stupid and even a cat may look at a king.

Given that he repeats the same thing over and over but refuses to have an conversation about it, I'd say the treatment he gets is to be expected.

X you need glasses. This thread is not about EROEI, it is about EROI. That is Energy return on INVESTMENT! When you are talking about investment you can compare different things. You can definitely figure out which type of energy INVESTMENT gives you the best returns. You can figure corn ethanol verses coal, or coal generated electricity or anything else. In other words what kind of bang do you get for each buck when looking at different types of energy.

Your rant would not work with EROI so you tried to change the subject of the thread to EROEI. Didn't work, you got caught.

Ron P.

This is the second post of mine in a row that got this same retort from x.

I think the sad reality is that X is yet to understand what EROI research really means, despite numerous posts here at TOD and peer-reviewed papers. X complains that a joule of ethanol is not the same as a joule of electricity which is not the same as a joule of oil, and that these quality differences discredit EROI analysis. Spoiler alert: WE KNOW about quality differences and have been dealing with quality adjustments in EROI calculations for nearly 20 years (see Cleveland 1992 for an easy explanation - although quality adjustments appeared much earlier). Now i would be the first to admit that there are still uncertainties involved when adjusting energy quantities via quality adjustments, but these uncertainties are no greater or worse than that which arise from discounting in cost-benefit analysis or other similar statistical techniques. Furthermore, nobody claims that EROI is the one and only statistic to be used, rather it is just another statistic, one which we feel is particularly enlightening in a world dominated by cost benefit analysis.

-Dave

Actually Ron, although I'm not in agreement with X's longstanding arguments for corn ethanol, I think this is indeed supposed to be a post about EROEI, that is the ratio between energy return and energy invested.

Indeed, that's rather what I'm on about in noting that EROI is an inherently-confusing acronym. You and I are both intelligent and quite educated, yet one of us (maybe me?) is wrong about what the article is even about.

Indeed, the metric used in much of this paper is "dollars", so maybe I am wrong: except that much of the rest would not make sense if it was about energy returned on money invested.

Again, I suggest that EROI be retired in favor of some unambiguous term.

Peak oil folks usually use EROEI while the rest of the world uses EROI. So you have the world to convince if you wish it changed.

Just curious, how do you calculate the EROEI of human labor, or that of a draft animal? What is the energy input of beans and taters, or hay? And how do you calculate the energy returned? One horsepower per horse? Or one manpower for each person? Wouldn't it be a hell of a lot easier if you just figured out how much you had to pay each man, or how much the hay upkeep of the horse cost, then figure out how much profit you made from what they produced?

I hope you get my point.

Ron P.

Hi Ron; I didn't sleep well, and the last thing I expected was to be posting today while waking up and perusing this article.

But I have raised a point; perhaps the author of the article could say whether I'm wrong or not.

Because you are an intelligent fellow, and when I'm awake I'm an intelligent fellow. You have said: "This thread is not about EROEI, it is about EROI. That is Energy return on INVESTMENT! When you are talking about investment you can compare different things. You can definitely figure out which type of energy INVESTMENT gives you the best returns." I have said "I think this is indeed supposed to be a post about EROEI, that is the ratio between energy return and energy invested." One of us is wrong about the central theme of the article. Even if that person is me, it illustrates the fact that the concepts are easily conflated and confused.

My understanding is that for reasons of precedent only, EROI is used by a small branch of energy-analysis academics to mean the ratio between energy invested and energy returned, despite the fact that the term "return on investment" and its acronym ROI has a default meaning in our society, and it's about money. Really, ask anybody. It would be better expressed as ER/EI or just making up a new word, IMO.

For instance, if it's about money, a 1:1 EROI is a ratio of different units, not a fundamental barrier. What would it even mean? The title of this series is "What is the Minimum EROI that a Sustainable Society Must Have?" If it was about money, that question wouldn't make much sense.

The important thing about EROEI or ER/EI is very important; it embodies a central truth which is fundamental to the foraging of bears and the survival of societies.

I've convinced the world to change things before, but if the TOD cognoscenti won't pick up the ball there's little likelihood others will. My expertise lies in getting things done in the real world, and I'm pointing out an unnecessary impediment to that. I certainly won't crusade, though; I'm familiar with the workings of academia.

I fully agree that energy returned on dollar investment is far easier to calculate. It's just that it's not what the article, indeed this series of articles is centrally about. Although this article itself seems to jump back and forth a bit, seemingly, while playing with both concepts.

There's a dead baby gecko on my desk which wasn't there last night. It performed the complex calculation of ER/EI by failing to forage efficiently enough and expiring after its egg hatched. The density of prey was not sufficient in my office for it to thrive.

by all means, the author of the article should let me know I'm wrong if I am.

__________________________________________________________

EDIT QUITE AWHILE LATER: testing 1-2-3... is this mic on?... paging Mr. Murphy... who's wrong about the theme of the article, me or Ron?

__________________________________________________________

EDIT SEVERAL ADDITIONAL HOURS LATER: I see a post from Will Stewart claiming that EROI means money in this article. I see new posts from a lot of other people who think it means energy return on energy invested. I see a number of posts by the author since I requested clarification. So once more, Mr. Murphy, if you please: is this series of articles primarily about energy return on energy invested, or energy return on money invested?

I like the article series a lot, but there is obviously confusion on this point. Please speak to it.

Concerning the issue of whether the article is about ERoEI or EROI, the author, David Murphy, uses the term EROI but switches back and forth between money invested and energy invested. In section 2.2 he is referring to money invested and in section 2.3 he is referring to energy invested as shown by:

The following sentence suggests the author thinks that EROI and ERoEI are approximately identical which may explain why he uses the concepts interchangeably:

I think equating EROI and ERoEI is nonsense because money is affected by many factors unrelated to energy such as inflation and OPEC artificially restricting production to force the price of crude oil up. During the oil price shock of 2008, the global average EROI should have decreased substantially while the global average ERoEI should have barely changed.

"For instance, if it's about money, a 1:1 EROI is a ratio of different units, not a fundamental barrier. What would it even mean?"

Exactly

If the economics of extraction are not there, it's a problem.

If the energy for extraction is not there, it's game over.

Seems to me the argument here is "what is money?" and is it the best indicator of the viability of extraction? and IMO its not. The dollar, which is the globally accepted unit of measure for energy (and all strategic resources for that matter) is so totally manipulated, debased, etc. that it would be dangerous and ignorant to rely on that as an indicator.

Other countries are waking up to this also and if anyone complains...there will be blood!

Greenish - here is my response, I hope it helps.

1. EROI, EROEI, Net Energy Ratio are all terms used synonymously within the academic literature. Fundamentally, EROEI implies that only energy inputs and energy outputs are used while EROI implies that a variety of different "investment" inputs (money, energy, etc) could be used to generate some energy output. Net Energy Ratio is another term used to describe the ratio of energy inputs to outputs.

That said, every EROI, EROEI, and NER calculation uses Energy out / Energy in to actually calculate the final value. EROI is never calculated as Energy out / money in. However, money is often used as a proxy for energy costs, but it is converted (usually using thermal equivalents and energy intensities (MJ/$)) to an energy unit before the calculation of EROI.

2. What is this series about: It is about the idea that energy surpluses are needed operate society. We provide (included in the next and last installment) a first attempt calculation at the minimum EROI (i.e. minimum surplus energy) needed to support the transportation system of the U.S. The article is not about EROI vs EROEI.

Does that help?

Actually, I wasn't looking for help so much as brief clarification to commenters. I'm on your side in wishing to see the concept of net energy more widely understood, and I think that the concept of "minimum ER/EI" for a given sort of society is both vastly important and entirely off the radar of most educated humans.

I only posted since I saw a very basic confusion developing within the comments, with some posters feeling you were writing about energy return on money invested, while others thinking you were writing about energy return on energy investment. I noted this as yet another clear example of an inherently and unnecessarily confusing terminology.

I sought brief clarification of a yes or no question which you waited a very long time to respond to, and still didn't directly answer in your response the next day. So at this point I'm also posting a bit on "academic timidity" using you as an example, which was far from my original intention.

I don't do so to bust your chops, but because I think that it's an additional important concept with direct bearing on whether or not this sort of thinking has the potential to go more mainstream in its current form. I understand that the paper itself is by niche academics for other niche academics, so is not flawed per se. My points are entirely about making the transition of concepts and methods from academic obscurity to mainstream acceptance.

For instance, when Ron posted - incorrectly - in rebuttal to X that this article was about money and not EROEI, you accepted his support against X without pointing out that he was incorrectly characterizing your article. This seems disingenuous. As author of a keypost, it should be you and not me pointing out that some respondents misunderstood the theme.

I take that as an indirect way of saying that I was correct and Ron was incorrect, in answer to the simple question I repeatedly posed yesterday. We certainly were not both correct since we said vastly different things. Again, a timid answer; by all means clarify if I have misinterpreted it.

I don't blame Ron or others for that misimpression: while I have enjoyed both articles and the larger paper they were pulled from; it was clear to me that you were talking about net energy since the writing only makes sense in that context, and indeed you defined it in the paper as net energy. However, it is obviously not clear to everyone. If I had done a keypost on the inadvisability of sloppy terminology in pushing a new concept, I could not have illustrated the point as well as it was here in response to your article, with very smart people talking past one another.

You state "EROEI implies that only energy inputs and energy outputs are used while EROI implies that a variety of different "investment" inputs (money, energy, etc) could be used to generate some energy output." That's the first time I've seen that stated. The use of the term "implies" in description of your central scientific term is something I find extraordinary. Moreover, how is this consistent with them being "used synonymously within the academic literature"? How is one to tell when they're synonymous and when something else is implied? Secret handshake? Gang tattoos? Reading between the lines?

I'm not a heckler, I'm a supporter. You've just defined your central term in two different ways. How can I not point that out?

I think that goal is very important. Presumably you would like this basic concept to gain broader understanding and acceptance. I don't have an acronym fetish; my expertise is in what works to insert a new idea into the culture. If Amazon called their new reading device a "Spatula" rather than a "Kindle", it would not be helpful... particularly if the ads for it featured a cooking motif. Although even that would be less egregious than this, since what's being presented is a rather intangible and non-intuitive concept with no obvious functionality to demonstrate.

It seems unfortunate to me that the authors - to the extent this paper is meant to push the concept to a broader audience at all - don't seem to understand the main conceptual hurdles faced when bringing the concept of "net energy" to a broader audience. Stuff like your section 2.2 should be kept a mile away from a mass-audience paper on net energy, since it tends to further confuse the issue in exactly the way the imprecise terminology promotes; and as proof I point you to the comments of other posters here, who have varying notions of what your paper is about. This is a very intelligent audience, and you haven't even made it clear to all those who have read it.

"Surplus energy" in principle has little to do with money; my example of the dead baby gecko is a decent illustration of this. The deep message is that baby geckos and human societies face the same ultimate tests. That core truth embodies a nearly Copernican revolution in the way we should see energy, and it should be treated with commensurate importance.

Indeed, one can imagine any number of sustainable societies which don't even use money, but I don't wish to digress further. I will simply point out the obvious once again: these concepts are not ready for prime time in this incarnation because they are confusing. They are not inherently confusing, they have been confused by a silly and arbitrary convention of terminology, and by an academic culture which is timidly hell-bent on not breaking with illogical precedent. And in this case, they are made more confusing by your hopping back and forth between the very concepts which will tend to be conflated due to this terminology, as in section 2.2 and 2.3.

Presumably, the goal of this paper is to begin to alert the general population and decision-makers to deep truths about the energy basis of society in the real world, and the nature of its limits. How in the world can that happen if the small clique of academics pushing it are - forgive me - promotionally obtuse? If they focus more on what their peers and elders think about precedent and correctness than about making the subject matter accessible outside their narrow specialty?

So thanks for the paper and article series, I've enjoyed them. And I hope I've given a little food for thought in how to improve them for a broader audience, should you care to do that.

cheers.

Thank you! That needed to be said.

I second that, Greenish. IMO, when speaking about EROEI (perhaps the most vital aspect of our energy future, and definitely the least appreciated) dollars should not even be mentioned. They are utterly irrelevant to the laws of thermodynamics that apply. And while I do understand why it is attempted, as energy input data is horrifically hard to come by, even attempting to use dollars as a proxy for energy inputs seriously confuses the issue, especially when attempting to take this topic to a broader audience, who are largely ignorant of energy units, processes and dynamics, and have been ingrained with the belief that throwing money at a problem can solve it. Well, not this one.

energy in food minus energy remaining in waste.

http://en.wikipedia.org/wiki/Calorimeter#Bomb_calorimeters

I agree with the first part, basically.

Another way to say it is that we can turn more of a less useful form of energy (sunlight) into a more desirable (liquid or gas). ROEI is an academic construct which can be defended only in the abstract. Since there is more energy in our environment (accessible with current technology) than we could ever use it's not a practical concept.

And yes we will build the machines to get that energy in a low oil environment.

Energy scarcity may impact the economy for a period of time. But the degenerative process describe by purest doomers is from a woefully inadequate model of how things work. It's "signs of the Apocalypse" for high IQ people.

Well it could be done if you are talking about using solar energy to generate hydrogen from water. But right now the EROI with batteries is much greater than the electricity you get from turning water into hydrogen then the hydrogen into electricity. The hydrogen hope has turned into The Hydrogen Hoax.

So really I doubt your statement that we will build machines to get that energy (efficiently). We already have machines that will do it but the cost is atrocious.

Ron P.

Efficiency doesn't matter. Cost and opportunity costs matter.

Efficiency may matter if you believe there is a shortage of energy. (As opposed to a shortage of a specific form of energy). Efficiency also matters if the energy conversion uses a limited resource (rare earth metals). But green energy companies know this. Hydrogen proponents understand the efficiency issue. But there looking at future cheap solar and new ways to make hydrogen. The "Hydrogen Hoax" guy is just just not very bright. There isn't enough lithium or lead to make the number of batteries needed. There isn't enough energy density in batteries. Going down multiple paths for oil replacement is smart.

Nonsense! The whole industrial revolution has been about improved efficiency. The flying shuttle enable the efficiency of cloth making to improve several fold. It is far more efficient to build roads, farm land, build bridges or do anything else with modern equipment than pure human labor alone.

The Egyptians built pyrmids with only human labor. It took tens of thousands many years to built one pyrmid. How many and how long would it take today? Efficiency is everything!

If we must depend on hydrogen made from water to power future transportation vehicles, we are in deep doo-doo indeed. There may not be enough lead or lithium to make batteries that still doesn't mean hydrogen power is a great idea.

Is It Time to Give Up the Hydrogen Hoax?

So you say the hydrogen hoax folks are not bery bright. Then that would be to say that the marketing people are the bright ones and the engineers are those who are not bery bright. I kinda doubt that.

Ron P.

Nothing you say here shows efficiency matter. The industrial revolution has been about cost per unit. Why does it matter how long it took to build the pyramids? You assume that for the decision makers fast would be better.

A black box making 1 MW costs $100000 to buy and one dollar a day to run. It's 10% efficient running on rock as fuel, and 90% efficient if run on sea water. Which process is preferable? Efficiency only matters as a function of costs.

As far as Hydrogen, if you can find a better way to turn electricity into a gas or liquid, great.

DC, your whole post is just silly. Greater efficiency means that one farmer can now produce what it once took 100 to produce. Efficiency means that a shoe factory can produce many pairs of shoes per day per employee. In the past it took one cobbler many days to just produce one pair. Greater efficiency is what feeds the world's population. Without greater efficiency of food production the world's population would be a fraction of what it is today. Not that this is a good thing or a bad thing, it is just what enabled the population to explode. But good or bad greater efficiency in food production was the most important thing that ever happened to humanity, population wise.

It is nothing short of insane to argue that efficiency doesn't matter. And as I write this I simply cannot believe that I am arguing with a person who claims that efficiency does not matter. I am beginning to think I am crazy for doing such a silly thing.

No I cannot! And that is the point. There is no efficient way to turn sunlight or electricity into a gas or liquid. That was my point DC! You were the one who claimed that it would be done. (Implying, whether you realize it or not, that it could be done efficiently.)

Ron P.

You need to read what I write. I'm making a precise argument that you have not come close to rebuking.

Let me try a simple question. Is a 17% efficient solar panel better than a 14% efficient solar panel?

Strictly in the context of your question, it depends on the scarcity of space. For example, if a properly sized 17% efficient set of panels does not take up the whole roof of a house but the 14% efficient array does, then there seems to be no difference. However, if a solar hot water heater is planned, and there is no more room for it, then efficiency becomes a factor.

H2O electrolysis and recombination via hydrogen is another matter. The 'round trip' efficiency has to be compared to other energy storage methods, along with cost, materials abundance, and longevity, among other factors, some of which are of high importance for mobile uses (i.e., weight, shock resistance, size, etc).

I think the answer depends far more on costs than on available space. eg. how many hours of my labour or other available valuable resources eg. firstborn son etc. must I trade for the 17% vs. the 14%? In an efficient market, that should translate into a simple calculation of installed-and-operating cost comparison for an equivalent output.

Darwinian, are you referring to efficiency or productivity?

Blue, they are two parts of the same thing. Greater efficiency improves productivity. The larger plow a tractor can pull the more land the farmer can plow in a day. The larger tractor enables him to be a more efficient farmer therefore he can produce a lot more.

Which is more efficient tool for harvesting wheat, the combine or the scythe? The combine of corse. One farmer with a combine can harvest more wheat over a hundred with scythes. Therefore, as I said before, one farmer can produce more than a hundred farmers once were able to produce.

Think of it this way, more efficient tools allow people to produce more. The more efficient tool allows one to produce more in a shorter period of time.

Ron P.

Bring this back to inefficient hydrogen production

I have a 1000:1 EROEI fast reactor creating electricity to hydrogen at an EROEI of 1:10. Does that give me a Total EROEI of 100:1? Wouldn't I then compare my hydrogen EROEI to alternatives?

Sure, let's compare it to using the reactor to charge batteries at 8:10. Then you get 800:1 and you choose the batteries. So how is it again that efficiency "doesn't matter"? I think you are trying to make the point that it's not the only thing that matters, but you've chosen the wrong words to make that point.

That is called economic efficiency.

The other one:

That answers your question about solar panels. Higher EROEI means in this case less panels and less space needed to get the same amount of usable energy.

Is the factor time important ? In this world certainly it is. It is even more important than fuel efficiency: ships and planes can save a lot of fuel by reducing speed. Up to about 30%.

dcmiller, are you sure ?

From Wikipedia:

There are allready EV's on the road and battery technique is improving rapidly.

The tesla motors battery pack is roughly 900 lbs from what I've read. If there is 35 million tons of lithium there is 7000000000 lbs of it. That's enough for 77,777,778 tesla motors vehicles. Let's say the cars are smaller and use a third of the lithium that tesla does. Is 234 million lithium eletric cars enough to replace the U.S. automobile fleet?

The other issue is how fast the lithium can be extracted.

Could be. Nick writes that there is enough lithium, maybe he has another calculation.

Yes. Some think that the maximum EV production is 6 million per year.

The tesla motors battery pack is roughly 900 lbs from what I've read

There isn't 900 lbs of lithium in the battery pack! I forget, but as a wild guess, there's maybe 50 lbs....

Is 234 million lithium eletric cars enough to replace the U.S. automobile fleet?

Actually, it would be, but of course the calculation that said we could only do 234M EVs is incorrect.

See http://energyfaq.blogspot.com/2009/02/could-we-run-out-of-lithium-for-ev...

Nick, the forbes article from your blog post says the volt's lithium-ion battery weighs 400 lbs, is this not entirely lithium? Can you provide any sources showing the amount of lithium present in a volt or tesla motor EV?

The Trouble with Lithium: Implications of Future PHEV Production for Lithium Demand, William Tahil, Research Director, Meridian International Research, January 2007, page 12 (327 kB PDF warning):

If a Chevy Volt battery is rated at 16 kW·hr, then it contains 4.8 kg of lithium. Tahil thinks there will not be enough lithium for EV's because the only economically viable reserves are in salt deposits.

Lithium-Ion Battery Recycling Issues, Linda Gaines, Argonne National Laboratory, May 21, 2009, provides a table on page 13 for various batteries. Gaines thinks recycling of lithium will be necessary. World reserves of contained lithium: 4.1 billion kg. Current amount of lithium used for other purposes: ~18 million kg / year.

The chemistry of a Chevy Volt battery seems to be some type of lithium-manganese. 4.8 kg of lithium per battery might be an over estimate.

More people are thinking this. That must be the reason that they are experimenting with other elements, like Zn.

Tahil was the first person to raise this issue - since then it has become pretty clear that lithium resources are adequate.

See the Gaines article just above for better information.

Gaines mentions this:

Tahil thinks for example this (mentioned by Bluetwilight):

Could be that with rising prices other reserves will become viable, but lithium is expensive allready.

And there is this:

Gaines mentions this: - Gaines thinks recycling of lithium will be necessary.

Yes. That's not a problem.

Tahil thinks

Tahil started this conversation - see my discussion here: http://energyfaq.blogspot.com/2009/02/could-we-run-out-of-lithium-for-ev...

lithium is expensive allready

At $2.75/lb for lithium carbonate, that's only $137.50, or 3.4% of the likely Volt battery cost of $4k (wholesale in 2-4 years). A doubling in the price of lithium would only increase the cost of a $30K vehicle (after $7,500 credit) by $137.50.

The total amount of Lithium metal required to make 60M PHEV20s with a small 5kWh LiIon battery would therefore be 90,000 tonnes – nearly 5 times current global Lithium production.

Again, that's Tahil's out of date info.

Tahil is referring to making batteries for the entire world production of automobiles, 60 million vehicles/year in 2006, while Gaines is referring to the subset of U.S. electric automobile production projected to peak at ~21 million vehicles/year in 2050 (465 million vehicles total, graph on page 9). Consequently, in a successful conversion scenario Gaines underestimates the global demand for lithium over the next 40 years by a rather large amount.

Gaines' table on page 13 shows the amount of lithium per battery with a 40 mile range for the four battery chemistries listed as 3.0 kg, 1.9 kg, 1.4 kg and 5.1 kg. This makes me suspect the estimate of 4.8 kg of lithium in a the battery of a Chevy Volt (based on Tahil's data) is a bit high. She assumes 300 W·hr/mile which uses 12 kW·hr/(40 miles) which is more energy than a Chevy Volt uses operating the battery at 50% discharge (8 kW·hr to drive and ~10 kW·hr to charge). She seems to assume a deeper discharge which would cause her lithium masses to be low. She could also be assuming the average efficiency of the battery over its lifetime.

Nick's blog entry, Could We Run Out of Lithium for EV Batteries uses a simple analysis that does not consider the technical and resource issues involved with tripling or quintupling lithium production at the few mining sites that produce the bulk of world lithium production. As with peak oil, the size of the tap, not the size of the tank, determines how much resource is available for use. Since recycled lithium will not become available until the batteries wear out in 10 to 20 years, the rate of production of PHEV's could be limited by the rate at which lithium production can be expanded. Since these mines will have to be expanded while Export Land Model rapidly shrinks the supply of crude oil and creates economic havoc, I am doubtful about Nick's optimism. The world might not be able to manufacture 60 million PHEV batteries per year using new lithium. If the batteries have a 10 to 20 mile range and a global economic depression reduces demand, the probability of satisfying demand would be improved.

the size of the tap, not the size of the tank, determines how much resource is available for use

As innumerable historical commodity boom & bust cycles have proven, commodity production is slow to increase in the short term, but generally catches up in just a few years and then overshoots demand.

EV's aren't going to grow overnight; lithium is generally quite abundant*; lithium prices could go up by 10x without endangering li-ion battery cost competitiveness; and there are a lot of alternative chemistries.

Export Land Model rapidly shrinks the supply of crude oil and creates economic havoc

ELM isn't a very helpful guide. It's much more useful to look at overall supply and demand in all countries. If you really want to look at a subset of supply and demand, I'd also look at a Import Land Model: US imports have fallen by 1.2M b/d in the last year.

* Here's one example:

"Geothermal power plants draw hot brine from underground as a power source, and these brines can contain dissolved minerals. Thus, for example the seven Geothermal plants at the Salton Sea are reported to be able to produce up to 16,000 tons of lithium per year. The facilities are better known as a source of zinc (pdf). However the potential as a source of lithium is becoming increasingly recognized."

http://bittooth.blogspot.com/2010/02/updated-look-at-lithium-production....

Engineer-Poet's comments on this: "16,000 metric tons of lithium is enough for 8 million Volt-class batteries, or enough to convert about 2/3 of the current US vehicle market to plug-ins.

This would take a while. By the time it was done, don't you think that we could develop some other sources? There's a lot more than just the Salton Sea brines out there; there's the Great Salt Lake (520,000 tons), and other sources adding up to over 4 million tons. 4 million tons is enough active material for 2 billion Volt-class packs, or 400 million packs of 80 kWh apiece. By the time we had to fall back to mining seawater to make up for recycling losses, I think we'd have more than enough to make do."

Yes, but lithium cannot be compared with copper or steel. How abundant it seems to be, it is only IIRC ranked on place nr. 25 in abundancy in the earth.

It seems that there is no problem for now. In the long run there is needed much more, part of which can be obtained from recycling. Apart from the possibility one can question if it is wise to do it. Growth, with finite or infinite resources cannot continue. Because there are other limits. Humanity is destroying the earth. Every year many thousands of species go extinct, deforestation and climate change is a growing problem. Dropping watertables and peak fosfor also. Every growth must and will come to an end. This counts for whatever species that devastatingly dominates others.

Growth, with finite or infinite resources cannot continue...Every growth must and will come to an end.

Sure, but it doesn't require growth in resource consumption to get there. An EV will take you places even better than an ICE, and if the electricity comes from wind...the passengers don't feel any difference.

The consumption of hard goods in developed economies levels off. Take a look at car sales and Vehicle Miles Traveled in the US: they've both leveled off. Ask Whirlpool if washer/dryer sales are continuing to grow exponentially (they'll tell you no....).

Humanity is destroying the earth... deforestation and climate change is a growing problem. Dropping watertables and peak fosfor also.

Those can be used renewably. We don't have to foul our air and water. Soil can be renewed and used without destroying it. And, in the very long-term, there's no reason we couldn't build food production that's completely isolated from nature: enormous hydroponic hot-houses. That's pretty theoretical, but I think that's kind've how you're thinking: where will we be in 500 years? Well, the answer is that there's no physical, technical reason we can't be just about wherever we want to be. If we want to reduce our footprint on wildlife habitat by retreating to giant domed cities that occupy 1% of the world's land (kind've like Singapore)....we could do so. If we really wanted to and needed to.

Every year many thousands of species go extinct,

Again, that's a choice. We can choose not to destroy habitat, etc.

Nick, I am not going to eagerly jump on an optimistic bandwagon without critically studying the subject. You mention the Great Salt Lake as a possible source of lithium, I follow your links to sources and discover:

being used as the minimum concentration in a range of known salt deposits. Tahil on page 8 indicates the Mg/Li ratio is 250 making this an uneconomic prospect for long into the future.

Another link indicates that SQM thinks the mine at Salar de Atacama, Chile, will never be economic to use fossil fueled kilns to dry the salty muck leaving the system stuck with slow, high water consuming, solar evaporation ponds. Tahil states:

which suggests there are few remaining resources to expand production there.

Tahil says that extraction from spodumene deposits will never be able to economically compete with extraction from salt deposits due to the high energy required for processing, eliminating a significant fraction of current lithium production. That means extraction from spodumene will decline and not return until the production capacity from salt deposits peaks at which time the world will be more severely energy making the cost difficult to estimate.

Jack Lifton argues that the concentration of lithium of 0.028% and the Mg/Li ratio of 19.9% makes extraction from Bolivia’s Uyuni Desert uneconomic at present. Thus the extraction of lithium from the world's largest deposit remains insignificant.

You make the statement, "lithium is generally quite abundant" in the Earth's crust, which is true, but you do not point out that the concentration is diffuse. Concentrating increasingly diffuse deposits of lithium will generally require increasing amounts of energy and resources. A declining ERoEI will eventually make the processing uneconomic.

Tahil argues that extracting lithium from seawater for use in EV/PHEV batteries is preposterous due to the financial and energy costs. Lithium from Bolivia's Uyuni Desert would be past peak production before anyone would be desperate enough to try large-scale extraction from seawater.

As for the lithium at the Salton Sea, stating the annual amount of lithium in the brine flowing through a zinc extraction plant is not the same thing as the potential extraction rate of lithium.

There will likely be additional expense to separate the other elements and compounds so the economics might be unsuitable. Assuming 200 ppm is a reference to weight and not molar concentration, the solar evaporation ponds would have to process 80 million metric tons of brine per year. That is about 80 million cubic meters. Assuming a pond .5 m deep requires a year to evaporate one needs a square about 13 km on each side. That is a lot of expensive agricultural land around the geothermal plants to purchase and destroy judging by the photo.

This is too complicated to make projections based on qualitative reasoning. We need a computer model that understands economics, ERoEI and resource constraints to figure it out.

I'll have to find some time to research this further. Let me answer some things in the meantime...

You mention the Great Salt Lake as a possible source of lithium

Well, no, that was Engineer-Poet.

Tahil on page 8 indicates the Mg/Li ratio is 250 making this an uneconomic prospect for long into the future.

But more economic than seawater.

Tahil says that extraction from spodumene deposits will never be able to economically compete with extraction from salt deposits

That's not feasibility, that's competitiveness.

extraction from spodumene will decline and not return until the production capacity from salt deposits peaks at which time the world will be more severely energy making the cost difficult to estimate.

That's assuming facts not in evidence: I don't think we have any real risk of "peak energy".

extraction from Bolivia’s Uyuni Desert uneconomic at present

Again, that's not feasibility, that's competitiveness. Lithium prices could rise by 10x, and li-ion batteries would still be economic.

Concentrating increasingly diffuse deposits of lithium will generally require increasing amounts of energy and resources. A declining ERoEI will eventually make the processing uneconomic.

E-ROI doesn't apply here. Again, Lithium prices could rise by 10x, and li-ion batteries would still be economic.

Tahil argues that extracting lithium from seawater for use in EV/PHEV batteries is preposterous due to the financial and energy costs.

Does he provide calculations to back that up? I agree that it's not likely to be competitive any time soon, if ever. That doesn't make it infeasible, as a limiting case.

Lithium from Bolivia's Uyuni Desert would be past peak production before anyone would be desperate enough to try large-scale extraction from seawater.

I'm not sure what you mean here. If conventional sources become increasingly expensive, there will be a move to what's available.

That is a lot of expensive agricultural land around the geothermal plants to purchase and destroy

A solution that takes less land is likely to be more expensive, and yet still be feasible.

This is too complicated to make projections based on qualitative reasoning. We need a computer model that understands economics, ERoEI and resource constraints to figure it out.

Tahil's argument is very simple: there are not sufficient resources to manufacture the needed batteries. That's not hard to disprove. Would a more sophisticated model be nice? Sure. OTOH, we start getting into very chaotic systems. If we could develop really effective econometric models that could predict commodity boom/bust cycles, we'd be really, really rich.

Nick, extracting Lithium from sea water can not be cheap. I live on the water and have never seen Lithium floating in it. It appears there is 0.1-0.2 lithium ppm in sea water. I've read that uranium can be extracted from sea water as well, it doesn't really seem like doing this would be economical.

How much sea water for a proper flow rate and energy would be required in order to recover that Lithium in sea water? At .1-.2 ppm I imagine it would require a massive water flow.

http://www.ioes.saga-u.ac.jp/ioes-study/li/recovery/seawater.html

I've read that uranium can be extracted from sea water as well, it doesn't really seem like doing this would be economical.

I agree - it's unlikely to be competitive cost-wise with other sources any time soon. It does seem likely to be feasible in the long-term, if necessary.

This competitiveness reduces the number of mines in operation reducing the rate of production. Increased production from the salt deposits will have to compensate.

The ERoEI of the fossil energy source(s) used to process the lithium is declining. More energy is needed to process increasingly diffuse deposits. More surplus energy is hard to obtain in this environment.

The ability of an economy to absorb a 10 times increase in the cost of lithium depends on why the price increases. If the price of the crude oil needed to ship the brine 50 miles to the processing plant increases, there is a double burden on the cost of manufacturing and the ability of the consumer to purchase the battery. The consumer has to simultaneously pay more for the battery and other items while his income fails to keep pace. The reason a spodumene deposit is more expensive to refine than a salt deposit is mainly the amount and thus cost of the energy used in production. The economic viability of lithium is determined both by the cost of production and the ability of the consumer to pay. Assumptions (like the consumer's ability to pay increasing or holding constant) that worked during the rising edge of world crude oil production may not hold during the falling edge. Life is good while the cost of things decreases and income rises, but bad when they are reversed. If the cost of necessities rises by, say, 4 times simultaneously with the price of lithium rising 10 times (due to more expensive energy and the need for more energy to process a spodumene deposit), the lithium-ion battery does not necessarily remain economic.

When you choose favorable assumptions, such as an abundant supply of energy to process lithium, the cost of the other materials used in the battery remaining static or declining, a constant ability of consumers to pay for batteries and all lithium reserves equally easy to produce (the price does not matter because it can increase 10x), you fail to disprove Tahil's argument. Gaines' analysis helps because she includes recycling, but one will probably have to wait 20 years before significant supplies of recycled lithium become available. The batteries will probably be in the cars for 10 years and then possibly used for load leveling of the electric grid for another 10 years. To disprove Tahil's argument one must carefully consider the rates of production from the existing lithium mines, how much those rates might change over the next 20 years and the rates of production from any new lithium mines that might be developed during the next 20 years. If we do not get the bulk of the conversion to PHEVs done before crude oil becomes scarce, we probably will not complete the conversion leaving the world with a reduced demand for lithium and fewer cars.

This competitiveness reduces the number of mines in operation reducing the rate of production.

If a resource is uncompetitive, it's not used until prices rise to the point that is becomes competitive. At that point, it becomes "economic", and it's use starts or expands.

The ERoEI of the fossil energy source(s) used to process the lithium is declining.

Not really. Sure, the E-ROI of oil and gas have fallen, but wind and coal are doing just fine. Really, oil is the only problem (we have enormous amounts of gas at less than $10 per decatherm, which is almost certainly an E-ROI of more than 10:1).

More energy is needed to process increasingly diffuse deposits.

True, though energy is unlikely to be the limiting factor.

More surplus energy is hard to obtain in this environment.

No, we have plenty of high E-ROI wind and coal.

If the price of the crude oil needed to ship the brine 50 miles to the processing plant increases

Then the processor is almost certainly going to move to something cheaper: an electrically powered pipeline, perhaps.

there is a double burden on the cost of manufacturing and the ability of the consumer to purchase the battery.

That starts to confuse the issue. We started with the large question of whether the economy is sustainable: I suggested that EVs were one solution, and we moved to the smaller issue of lithium. Let's stick with lithium, for the moment, else the argument becomes circular. The economy will fail for lack of energy; why a lack of energy? because the economy will fail; why will the economy fail? because of a lack of energy, and so on, ad infinitum.

The reason a spodumene deposit is more expensive to refine than a salt deposit is mainly the amount and thus cost of the energy used in production.

No, it's mostly labor. Energy is a small % of most mining, processing and manufacturing (there are large exceptions, of course).

When you choose favorable assumptions...you fail to disprove Tahil's argument

Tahil doesn't make any of those arguments - he's just arguing that there is inadequate lithium resource.

To disprove Tahil's argument one must carefully consider the rates of production from the existing lithium mines

No, that's not his argument. He doesn't examine alternative sources and suggest that they are available, but can't be developed quickly enough. Further, anyone with experience with mining will tell you that argument is unrealistic: give Rio Tinto 5 years and an adequate resource to work with, and they'll give you pretty much whatever you need.

In The Tourble with Lithium 2: Under the Microscope (2008 May 29), page 2, Meridian International Research responded to that argument:

They argue that the increasing demand for lithium for computer batteries will consume most of the foreseeable production increases at the mines.

On page 35 a detailed consideration of lithium production from sea water is given showing how ridiculous that process would be.

He estimates that there will be sufficient lithium available to allow production of 1.5M GM Volt type vehicles by 2015. That doesn't appear to indicate a short-term problem.

They would have higher production costs and lower production rates than the South American and Chinese brine deposits

Both in this summary, and in many points of the study, he seems to be confusing feasibility and competitiveness. Given that lithium pricing could rise by 10x and still allow affordable batteries, this is important. Many of the analyses he points to say that a particular source wasn't economic - that tells us very, very little about the value of the resource in a rising price environment.

For example, he doesn't include 23,000 tons/year in North Carolina, because it was slightly more expensive than brine sources.

unproven and heretofore undeveloped processes. All such nebulous resources were excluded

This appears arbitrary, especially for a long-term forecast. It doesn't allow the author to say anything stronger than "there may be a problem - this bears further study".

For example, he dismisses very, very large resources in the Congo (.6 to 4.6 billion pounds) as being distant, and in an unreliable country. That's way too superficial.

On page 35 a detailed consideration of lithium production from sea water is given showing how ridiculous that process would be.

That's a mighty superficial analysis. It amounts to saying: "Gosh, you'd have to process a lot of water!". I've seen similar arguments that purported to debunk solar and wind power ("Gosh, you'd have to use a lot of land!"). You really need to start to address cost and process. I have to think someone has made tentative proposals in this regard - he could address them seriously.

As for the amount of lithium in a battery for a Chevy Volt:

Tahil's data gives 4.8 kg.

Gaines' data, assuming one of the battery chemistries is applicable, gives a range from: 1.4 kg to 5.1 kg.

Engineer-Poet's comment gives: 2 kg.

Does anyone have a reliable reference?

I tend to agree that, as yet, this sort of analysis is far too simplistic to the point of useless. In point, the positioning of "nuclear energy" on the graph above. What is ignored is that nuclear energy is all produced as electricity, which is provably at least twice as "useful" (econiomically utilitarian) as natural gas and closer to three times as "useful" as coal (simply based on the average plant efficiencies of installations which convert those fuels into electricity) or is the correct number six times as useful (based on using the electricity in a COP 5.5 heat pump to do the same space heating job as a 90% efficient natural gas furnace)? What is the relative economic value / utility to a steel mill of 1 GJ of electricity turning a rolling mill motor vs. 1 GJ of coking coal?

This sort of information is less than useful, it is misleading with a bias to reinforce an erroneous agenda.

The real analysis as FAR more complex.

Actually I agree in part with x although x may not like the conclusion I draw. What form of EI is important, because the EI has an ERoEI itself. This matters most if the ERoEI of the EI is very low. Thus if you used corn based ethanol to produce CB ethanol you have a different outcome than if your EI is 20:1 oil. You couldn't do it. I think the same will hold true for solar and wind. You can produce them with relatively high ERoEI oil and get a positive figure but once you have nothing but solar and wind to make new panels or windmills you will end up with a negative. Thus you need to add into the EI the energy used to extract it. The EROI would also be effected but by specifying the type of EI you would get a clearer picture of whether or not an alternative will be viable after the age of oil.

Strictly speaking, you don't get a negative. Suppose you have a two part process, the first part of which has an EROEI of 20:1 and produces inputs for the second part which has an EROEI of 4:1. The overall EROEI is 80:1. If you the EROEI for the inputs then drops to 5:1, your overall EROEI drops from 80:1 to 20:1. That's a huge drop but it's not the same as "ending up with a negative."

Note that in David's graph wind and solar PV are still above the threshold to maintain "civilization", whatever that is.

jaggedben, that depends on whether or not you are counting ALL the inputs to solar and wind, such as the energy credits to employees, energy to maintain roads to transport raw materials or the energy to keep a large military to protect your right to expropriate raw materials that exist in other parts of the world.

No if your ERoEI is 20:1 and your ERoEI of the input is 4:1 then your actual ERoEI is 20:1.25 or 16:1 not 80:1. But that said, I should have said might. If solar and wind are really 4:1 and 20:1 after you include all the uncounted inputs you would not end up with a negative. No question that ethanol would be a negative and probably already is per Pimental.

I do agree that there is a large amount of uncertainty as to what such inputs amount to and also whether they are necessary. Which is why I said "strictly speaking...".

You got the math wrong and also got my example backwards. I clearly stated that the first part (20:1) produces the input for the second part. Even so, the other way around still produces 80:1, and I'm baffled as to which numbers you crunched to get 1.25.

Also, I was certainly not referring to solar and wind respectively with my 20:1 and 4:1. (Actually, I had oil and solar in mind, but don't take the numbers as referring to real world examples. My point was about the math.)

OK I did get what you were saying turned around, but you are still wrong. At 20:1 it takes 1 BOE to get 20 or .05 to get 1 BOE. If that is your input then the 1 BOE that gets 4 is actually 1.05 BOE - thus 4:1.05 which is about 3.8:1

If you drop down to using as your input 5:1 that would mean that each barrel would require .2 for input so you would now have 4:1.2 or 3.3:1.

I am baffled as to how you would think you could add in the addition BOE to get your input to that input and get a better ERoEI. You are in essence saying that solar (4:1) which now is made using oil (20:1) actually getting 80:1. We don't extract any oil at 80:1 anymore. If I have to use oil to get oil to make solar how can I quadruple my ERoEI. If that were so there would be solar panels everywhere.

I said it was a two part process, and yet you insist on looking only at the second part of the process. For the whole process, if I start with one unit of energy, get 20 units of energy back in the first part, then take all 20 units of energy and get 4 back for each of them, then at the end of the whole process I've gotten 80 for one. The intermediate 20 are not counted as inputs or outputs of the process as a whole, since they are internal to it.

The reason people don't use oil exclusively for making solar panels is because it's not competitive on the market. The company that takes one unit of energy and offers you 20 in return will be able to offer you energy at a lower price than the one that offers you only 4 in return. Put another way, if the intermediate 20 in the above example can be used to get 400 instead of 80, people will go for the 400.

Thus, 'solar' will generally not be competitive with 'oil' as long as solar's EROEI is more than marginally lower than oil's, even if solar's EROEI is high. Nonetheless, lots of people are installing solar panels everywhere, because it does offer an energy (and thus a financial) return, and they can put solar panels on their roof even when they cannot drill for oil in their backyard.

I am quite surprised by the lack of critical thinking when people make statements like:

>> EROEI is not valid when comparing different forms of energy since there might be a gain in utility or other attributes that offset low EROEI numbers.

& then people dance around on the other side of argument. The basic fact is that EROEI is a necessary condition for a system to be viable but it is definitely not the sufficient condition. In other words the fact that You gotta get significantly more energy return than what you put in is quite basic. Unless you gotta convert it in a form that is very desirable. However even that scenario is plausible as long as you have ample energy to 'waste'. My contention there is that when serious oil decline kicks in you won't have loads of energy (in usable form such as oil) to throw at such low efficiency endeavors.

The other thing (& I wanted to say this to a gentleman arguing with Gail yesterday about there being no dearth of good investments in specific areas even after oil decline kicks in) is that there may be good niche investments out there but as capital returns wane & economy stagnates/declines the cost of discovering good investment starts to become quite. So high in other words failures will be difficult to sallow & the risk appetite will be quite low.

If you ask me I'll say starting tomorrow we should spend every last bit of this highly concentrated energy source (oil) into creating other high EROEI sources such as wind & solar.

Also, Purely from corn ethanol's point of view, it is quite absurd to want to convert oil energy to ethanol at 1.3 EROEI. The only reason it seems okay for now is that the cost of energy that goes into the process is hidden away & quite subsidized by easy to obtain oil from mega-fields which are not yet (questionably) in decline.

I would be favor algae-based biomass ethanol much more than corn though but even that will have scalability issues. But I have a feeling that the corn-ethanol nonsense will wane away when oil starts to become really expensive & the real price of all the 'non directly oil' components starts to skyrocket. At that point the govt subsidies will have to be increased significantly. But then again political factors are the only reason holding corn ethanol in place & who knows how they play out going forward.

That's probably true in some situations. But I expect future energy will be like drinking water. The problem is one of distribution, not quantity. What TOD generally ignores is that energy conversion devices are designed by cost of production, not energy in. The market is the mechanism that will handle most of the change away from oil. We don't need to make PV panels with oil energy. Nothing in the supply chain needs oil energy.

If energy wasn't essentially infinite, or we were not a technological society, the situation would be dire. But oil brought us to semiconductors, genetic engineering, and amazing material sciences. That's plenty far enough to now lose oil. It's almost like mother earth fed us oil until we could evolve into cleaner energies. It's pretty cool that oil will decline as the eco system may need it to decline.

huh? What? Who is claiming or ignoring the fact that energy converters are designed on a least cost basis?

One way the market could "handle" the change away from oil is to simply force people to use far less energy.

You are thinking many moves ahead. The question is if all the moves can be made.

Can the economy keep on growing that way ?

I'm not sure if you profoundly understand the exponential function.

The energy input into making ethanol includes natural gas and coal, not just crude oil. (energy returned in ethanol) / (energy input as crude oil) should be much larger than 1.3.